|

Cash and cashflow. The half yearly spend is a little over

£10m, on a falling trend.

Oct 27. RNS gave good news on income etc as forecast

in the interim report. |

The company appears to have funding of about £40m in place,

including the cash from the placing and open offer (£18.4M).

This should be set against falling R&D costs and rising revenues

(interim RNS) It would appear to have been very fortunate in the

timing! As to whether the downturn will affect income rates, well

some products might actually sell more as a result!

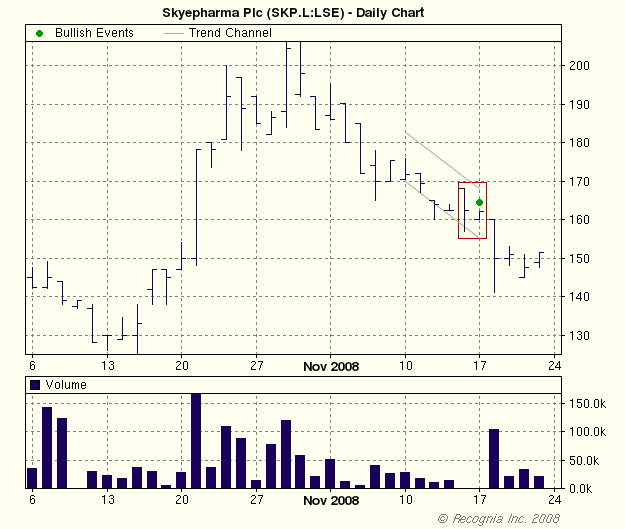

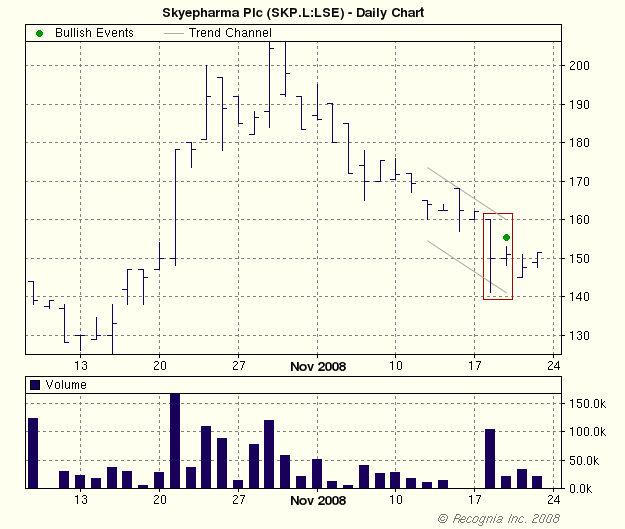

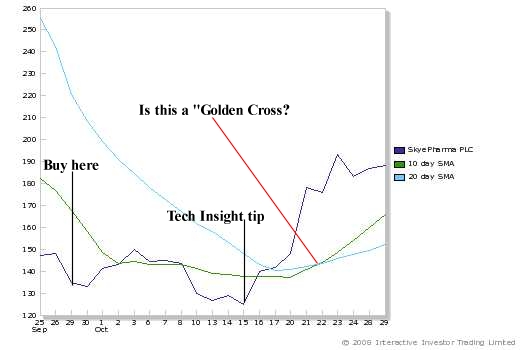

Oct

14th. Signal that price was about to rally or sidetrack. It

did so! Oct 21st - a major move on higher volume - touched 178p! High

for shares post consolidation. Now 202-204 - new post consolidation

high 207 (Intra Day).

Glaxo also

reports sales of Requip doubled in the 3 months to 30 Sept over the

previous 6 months, reinforcing what SKP stated in the interims.

Further progress to Dec 31! Paxil CR is also up! |

|

Stated reasons

for the open offer in the proforma. |

Funds raised by

the Placing and Open Offer will be used to provide working capital to

enhance the core oral and inhalation business and in particular to

protect shareholders' interests in Flutiform* and other pipeline

products, to enable the Group to become profitable and deliver

long-term value for Shareholders, and to meet the expenses of the

Bond Proposals and of the Placing and Open Offer. |