236

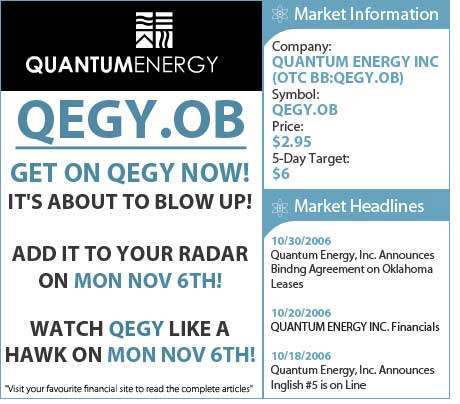

Boiler Rooms P2

This page has more comments and announcements and other info related to the subject.

|

Defined as offshore sellers of shares. They work by e.mail contact, but most often by telephone, almost always with number withheld - offshore doesn't show up on my NTL system. |

|

|

Where do they get your details? |

|

|

Share register occasionally. This is a source for mail hard copy SPAM, as well as the electronic variety. |

Questionnaire you responded to, often on a legit website as a popup. |