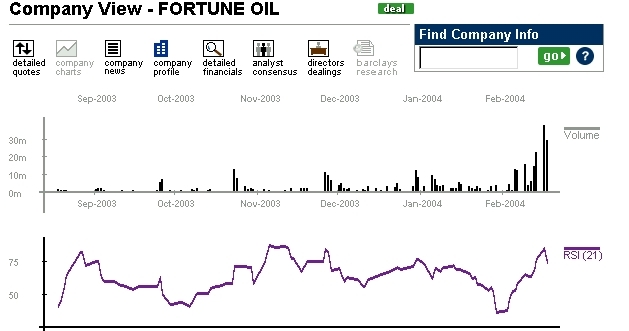

Fortune Oil

Page details. The linked page has shareprice links too.

This page contains the text of three significant recent announced events and the pipeline project

Company official webpage here - see e.mail link.

Mail details see the foot of this page Reporting see below.

Late April or Early May

Report for the previous calendar year up to end December.

Late September

Report for the calendar half year up to end June.